Marwood advises on buy-side and sell-side transactions, having supported $500B+ in M&A and financing across the healthcare spectrum

Clinical Trial Site Management Organization

Marwood Case Study

Engagement Purpose

A private equity firm was considering a potential investment in a multi-location site management organization (SMO) and engaged Marwood to conduct a market study to assess regulatory impacts (ex. FDA) as well as market size, clinical and drug pipelines; competitive analysis to ascertain viewpoints from CROs and pharmaceutical companies on SMO services were also addressed.

Marwood Analysis

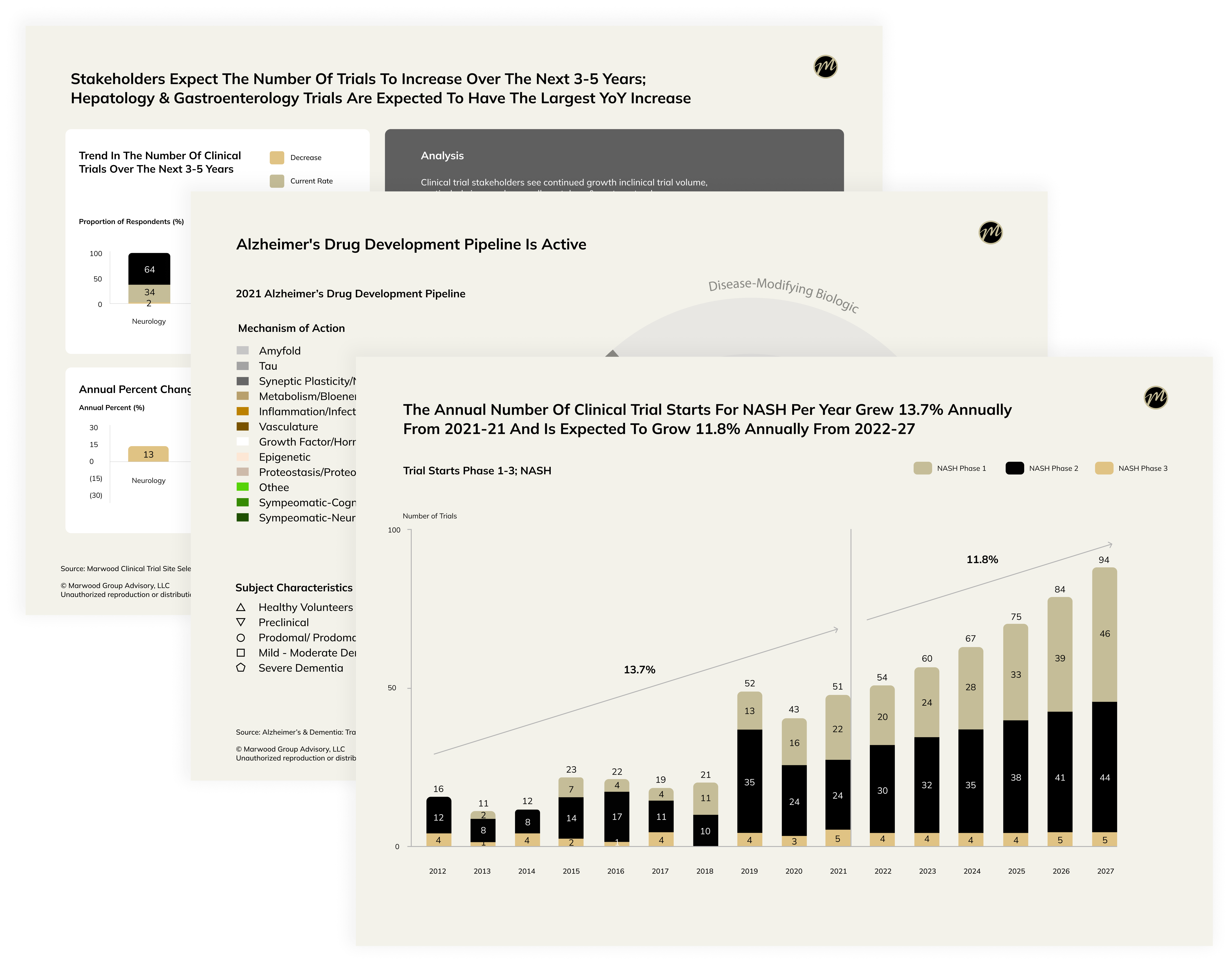

- Assessed market size, growth and drug pipeline for key therapeutic areas, inclusive of market growth, landscape and key growth drivers for clinical research site services.

- Evaluated regulatory trends pertaining to drug approvals, pipeline clinical trial process.

- Surveyed key pharmaceutical and CRO stakeholders to garner insight on competitive dynamics in the CRO/SMO services space.

Key Findings

Marwood characterized the potential clinical opportunity within the target disease state and region, including patient demographics and potential to staff with qualified labor. Market sizing studies supported by secondary research, surveys and interviews quantified the opportunity for the Company. Future scan identified therapeutic and technological opportunities synergistic to the Company’s current resources to enhance recruitment diversity to align with FDA guidance.